Herndon, VA — AllTrust Networks is pleased to announce the release of SmartCheck Mobile, a complete mobile check cashing ecosystem for money service businesses and retailers. The new mobile product is an extension of AllTrust’s API-based SmartCheck platform, leveraging dozens of features that allow for customer enrollment, verification and real-time transaction decisioning.

AllTrust’s retail partners can now offer their consumers a smartphone app to self-enroll and cash checks. Depending upon the implementation, consumers will receive in-app approvals and be directed to a store to pick-up their cash, or have the funds immediately sent to any bank issued debit card.

SmartCheck Mobile is available to partners via SDK or as a white label mobile app that extends their brand to consumers. By integrating with in-store systems and kiosks, SmartCheck Mobile provides a seamless consumer experience to turn their checks into cash. Getting pre-approved before leaving their jobs or homes removes the anxiety and friction of waiting in retail lines and then hoping to get approved.

SmartCheck Mobile is available to partners via SDK or as a white label mobile app that extends their brand to consumers. By integrating with in-store systems and kiosks, SmartCheck Mobile provides a seamless consumer experience to turn their checks into cash. Getting pre-approved before leaving their jobs or homes removes the anxiety and friction of waiting in retail lines and then hoping to get approved.

For retailers, customer self-enrollment and scanning checks via their mobile phones saves critical time in stores and allows for pre-approved customers to head directly to the checkout. In some cases, AllTrust will guarantee the transactions, allowing retailers to offer a valuable service without large investments in hardware, risk management and employee training.

AllTrust’s first partner for its mobile product is Anytime Cash, a leading innovator of financial services kiosks. Founded by industry veterans Chris and Peter Delborrello, Anytime Cash is deploying kiosks and mobile apps using the AllTrust platform to enhance and expand their chain of United Check Cashing stores based in Philadelphia.

“The AllTrust platform allows us to manage the risks associated with cashing checks and automate the process as much as possible. Now with SmartCheck Mobile, we feel that we can serve our customers even better. Customers take a picture of their ID and their check, and boom we approve it – it doesn’t get any easier than that”, said Pete Delborrello.

“Working with Anytime Cash has been terrific! Their combination of deep knowledge of the check cashing industry and the innovative implementation of kiosks and mobile in coordination with their brick-and-mortar stores puts them on the leading edge of money services for the millennial generation”, said Jon Dorsey, AllTrust’s EVP of Business Development.

AllTrust Networks offers a flexible and comprehensive platform with 200-APIs for discrete functions of customer enrollment, check imaging, data extraction and handling electronic deposits directly to partner banks. AllTrust partners use various back office web-based functions while the APIs allow for integration into their own POS systems. Now with mobile applications, AllTrust can help facilitate true omnichannel support for its partners offering financial services. With the option of fulfillment in-store, kiosk, or pushing funds to a reloadable card, SmartCheck Mobile is adaptable to a variety of business models.

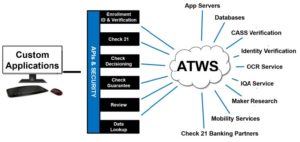

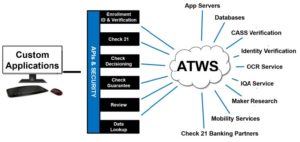

Herndon, VA — AllTrust Networks is excited to announce the release of AllTrust Web Services (ATWS), an API-driven platform that enables third parties to build custom check cashing applications using AllTrust services. AllTrust offers a variety of services including customer enrollment, identity management, check decisioning, Check 21 deposits, government compliance reporting, and other capabilities. Fully documented APIs within an integrated testing environment simplifies development of custom applications

“Cashing checks continues to be the most effective way to attract and retain customers within the alternate financial services industry. However, it is difficult to do well and potentially a high-risk activity when not done well. AllTrust’s expertise with thousands of businesses over a sixteen-year period is now available for the first time to third party software providers and the in-house development teams of our customers.” said Karl Lewis, AllTrust’s CEO.

With the ability to mix and match the available services, ATWS can be used for a variety of applications:

- Integrate check cashing, compliance and Check 21 deposit services into a money transfer application

- Provide immediate funds availability at an ATM terminal based on customizable decisioning rules

- Use identity management to add check cashing to a point of sale system

- Build money services kiosks with customer enrollment and check acceptance capabilities

- Add centralized second-level review services to existing check cashing applications

- Integrate the AllTrust Check 21 deposit service into any system

- Add check cashing to mobile wallets and payment apps

AllTrust Web Services is the industry’s first platform to enable customers and third parties to build custom check cashing solutions. The platform is ideal for money transfer companies, banks, and kiosk providers to add riskmanaged check cashing into their products. With a menu of services available, ATWS makes it easy for our customers to pick and choose what features to best serve the needs of their business.

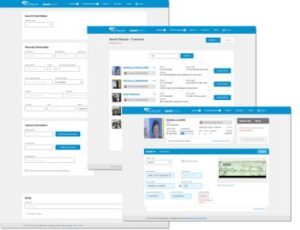

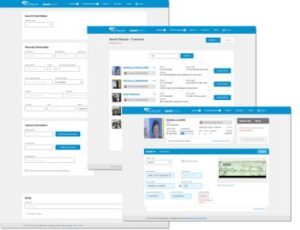

Herndon, VA — AllTrust Networks is pleased to announce the release of SmartCheck, our newest check cashing product. Built on a web-based platform, SmartCheck is designed from the ground up to support large chains that require comprehensive back office controls, centralized risk management, and integrated government compliance. With support for Windows 7, 8 and 10, SmartCheck will work across multiple browsers, including Chrome, Firefox and Internet Explorer.

Leveraging 16 years of experience with check cashing products like Paycheck Secure, PCS Online and Retail Connect, SmartCheck combines best-in-class features with excellent reliability and ease of use.

Leveraging 16 years of experience with check cashing products like Paycheck Secure, PCS Online and Retail Connect, SmartCheck combines best-in-class features with excellent reliability and ease of use.

“We are excited to offer SmartCheck, our latest check cashing software product. Unlike traditional check cashing solutions, SmartCheck is completely web-based to ensure better reliability, lower cost of operations and the continuous addition of new features. Our large customers will be able to leverage the centralized risk management, pricing rules and government compliance to more effectively manage their business.” said Karl Lewis, AllTrust’s CEO.

With premium features to accommodate grocery, retail and MSB chains of any size, SmartCheck is a complete check cashing solution. Features include:

- High performance web interface that works across multiple browsers

- Cloud-based data repositories for sharing customer and maker information across all stores within a chain

- Support for a variety of check readers, ID scanners and other devices without the use of browser plug-ins

- Flexible risk settings with numerically driven scoring and decision management

- Comprehensive pricing rules by check type and risk factors

- Second-level check reviews can be performed by a floor manager or centralized across multiple stores, web-based or mobile

- A variety of verification services including check maker research, customer cell phone, address, and email

- Industry’s best protection against fraudsters with access to AllTrust’s national fraudster database

- Full government compliance and integrated reporting for CTRs and SARs

- Automated Check 21 electronic deposits

- Check Guarantee program available

Herndon, VA — AllTrust Networks is pleased to announce support for Windows 10. Paycheck Secure, the nation’s leading software for check cashing and alternative financial services, is now compatible with the latest Windows platform, offering improved performance, plug-and-play integration and a user-friendly interface. With backward compatibility for Windows 7 & 8, Paycheck Secure for Windows 10 supports a variety of configurations. With packages starting as low as $50/month, customers can pick and choose which options best fit their need.

“We are excited to offer Paycheck Secure for Windows 10. We know our customers will take advantage of the latest features of Microsoft Windows and we are committed to providing the most up to date software. A high performance platform with rich customization capabilities, Paycheck Secure is the best software available in the marketplace.” said Karl Lewis, AllTrust’s CEO.

Paycheck Secure is a total check cashing solution, with premium features to accommodate grocery, retail and MSB chains of any size. Options include:

- Industry’s best protection against fraudsters, including fingerprint biometric enrollment and identification with access to AllTrust’s national fraudster database

- High performance platform offers merchants faster lines and better customer service

- Full government compliance and integrated reporting for CTRs and SARs

- Automated Check 21 electronic deposits • Integrated check maker research

- AllTrust Review Center services for 3rd party decision assistance

- Check Guarantee program

- Automated data backup to AllTrust’s private, secure network

- PCS Online, a web-based version of Paycheck Secure, is available

- Hardware and software packages to fit any budget

AllTrust Networks provides best in class solutions while developing new products for a changing marketplace.

Herndon, VA — AllTrust Networks releases PCS Online, a web-based version of the Paycheck Secure check cashing solution. PCS Online has many of the same features as the PC desktop client version of Paycheck Secure, but is accessible via a web browser with all the data being stored in the AllTrust cloud network. This reduces hardware costs, eliminates software maintenance, protects against data loss, and ensures that our customers are always working with the latest version of the software.

Like Paycheck Secure, PCS Online offers a variety of configuration options and modular pricing plans. Customers can pick and choose which options best fit their business needs, as well as vary features by store location to scale their business appropriately.

“Our customers have been asking for a web-based check cashing solution with simplified features, and we are excited to offer this new iteration of Paycheck Secure. With a lower entry level price starting at $50 per month, PCS Online is ideal for merchants and money service businesses who need a lower volume solution.” said Karl Lewis, AllTrust’s CEO.

PCS Online is a total check cashing solution, with premium features to accommodate retail customers and chain locations of any size. Options include:

- Industry’s best protection against fraudsters, including access to AllTrust’s national fraudster database

- Full government compliance and integrated reporting for CTRs and SARs

- Automated Check 21 electronic deposit service available

- Integrated check maker research service available

- AllTrust Review Center services for 3rd party decision assistance

- Check Guarantee program

- Integral data backup to AllTrust’s cloud network

- Packages available to fit any budget

AllTrust Networks is proud to continue providing its customers best in class solutions and developing new products for a changing marketplace.

Herndon, VA — AllTrust Networks releases Paycheck Secure for Windows 8 including new modular pricing options. Paycheck Secure, the nations leading software for check cashing and alternate financial services, is now compatible with the latest Windows platform, offering improved performance, plug-and-play integration and an improved user-friendly interface for our customers. With backward compatibility for Windows 7, this latest release supports a variety of configuration options. With new modular pricing plans, starting at only $60/month, customers can pick and choose which options best fit their business need.

“We are excited to offer this new iteration of Paycheck Secure to our customers. The improved performance provides better support for large chains. Coupled with our new, modular pricing structure, customers can vary features by store and scale their business appropriately,” said Karl Lewis, AllTrust’s CEO.

Paycheck Secure for Windows 8 is the total check cashing solution, with premium features to accommodate retail customers and chains of any size. Options include:

- Industry’s best protection against fraudsters, including optional fingerprint biometric enrollment and identification including access to AllTrust’s national fraudster database;

- High performance platform offers customers faster lines and better customer service, now able to support very large merchants with 1000 or more stores;

- Full government compliance and integrated reporting for CTRs and SARs;

- Automated Check 21 electronic deposits;

- Integrated check maker research;

- AllTrust Review Center services for 3rd party decision assistance;

- Check Guarantee program;

- Automated data backup to AllTrust’s private, secure network;

- Hardware and software packages available to fit any budget.

AllTrust Networks will continue to provide its customers best in class solutions while continuing to develop the new products required for a changing marketplace.

Herndon, VA — AllTrust Networks is pleased to announce the addition of Karl Lewis to the executive management team, serving as CEO. Mr. Lewis brings 25 years of entrepreneurial business experience across a broad spectrum of technology-based companies. In this leadership position, Mr. Lewis will be responsible for the strategic direction of the company as well as day to day operations. Jon Dorsey, the previous CEO, will remain on the executive team as EVP of Business Development leading the deployment of the company’s new web services check cashing platform.

“We are excited to have Karl join the team,” said Jonathan Wallace, chairman of the board. “The check cashing industry is rapidly evolving with the advent of web-based apps, mobile apps, and digital wallets. Karl’s deep background in software development, payment systems and business operations will be instrumental in establishing the vision and growth strategy for the company.”

Mr. Lewis has held leadership positions in a variety of industries ranging from Fortune 100 to bootstrap startup. Throughout his career, Mr. Lewis has focused on launching businesses that leverage new technology to change an industry. Mr. Lewis has held leadership positions in sales, marketing, product development, operations, finance, and corporate development. His career has spanned multiple companies in the technology arena including: MCI, Proxicom, Cigital, GridPoint, and Treater plus advisory services to multiple start-ups. Mr. Lewis holds a BA in Economics from St. Mary’s College of Maryland.

“I am looking forward to working with the AllTrust Networks team,” said Mr. Lewis. “Their deep experience in analytics-based decisioning and compliance management is a strategic asset in the development of advanced check cashing solutions. AllTrust Networks will continue to provide its customers best in class solutions while developing the new products required for a changing marketplace.”

Herndon, VA — AllTrust Networks and La Chiquita Express announced that Paycheck Secure, AllTrust’s fingerprint check cashing service, is now available at six La Chiquita Express check cashing locations in Maryland.

La Chiquita Express is a financial service center providing services to the Hispanic community in Maryland. As one of the highest-volume money service providers in the county, moving the line quickly is important. Paycheck Secure identifies customers with a simple finger scan, bypassing all the searching and typing required by other systems.

Paycheck Secure also reduces fraud for La Chiquita by leveraging its fingerprint-driven fraud database. ”Right after we installed the system, we identified customers who had passed bad checks at nearby Paycheck Secure locations and were able to decline those checks,” said La Chiquita’s owner, German Escobar. “The criminals know to try somewhere else now.”

Signing up to cash checks using Paycheck Secure is quick and easy. Customers simply provide a photo ID; two finger scans, and a smile for a digital photograph. Once enrolled, shoppers can quickly and securely cash checks with a quick finger scan at any La Chiquita location.

SmartCheck Mobile is available to partners via SDK or as a white label mobile app that extends their brand to consumers. By integrating with in-store systems and kiosks, SmartCheck Mobile provides a seamless consumer experience to turn their checks into cash. Getting pre-approved before leaving their jobs or homes removes the anxiety and friction of waiting in retail lines and then hoping to get approved.

SmartCheck Mobile is available to partners via SDK or as a white label mobile app that extends their brand to consumers. By integrating with in-store systems and kiosks, SmartCheck Mobile provides a seamless consumer experience to turn their checks into cash. Getting pre-approved before leaving their jobs or homes removes the anxiety and friction of waiting in retail lines and then hoping to get approved.

Leveraging 16 years of experience with check cashing products like Paycheck Secure, PCS Online and Retail Connect, SmartCheck combines best-in-class features with excellent reliability and ease of use.

Leveraging 16 years of experience with check cashing products like Paycheck Secure, PCS Online and Retail Connect, SmartCheck combines best-in-class features with excellent reliability and ease of use.